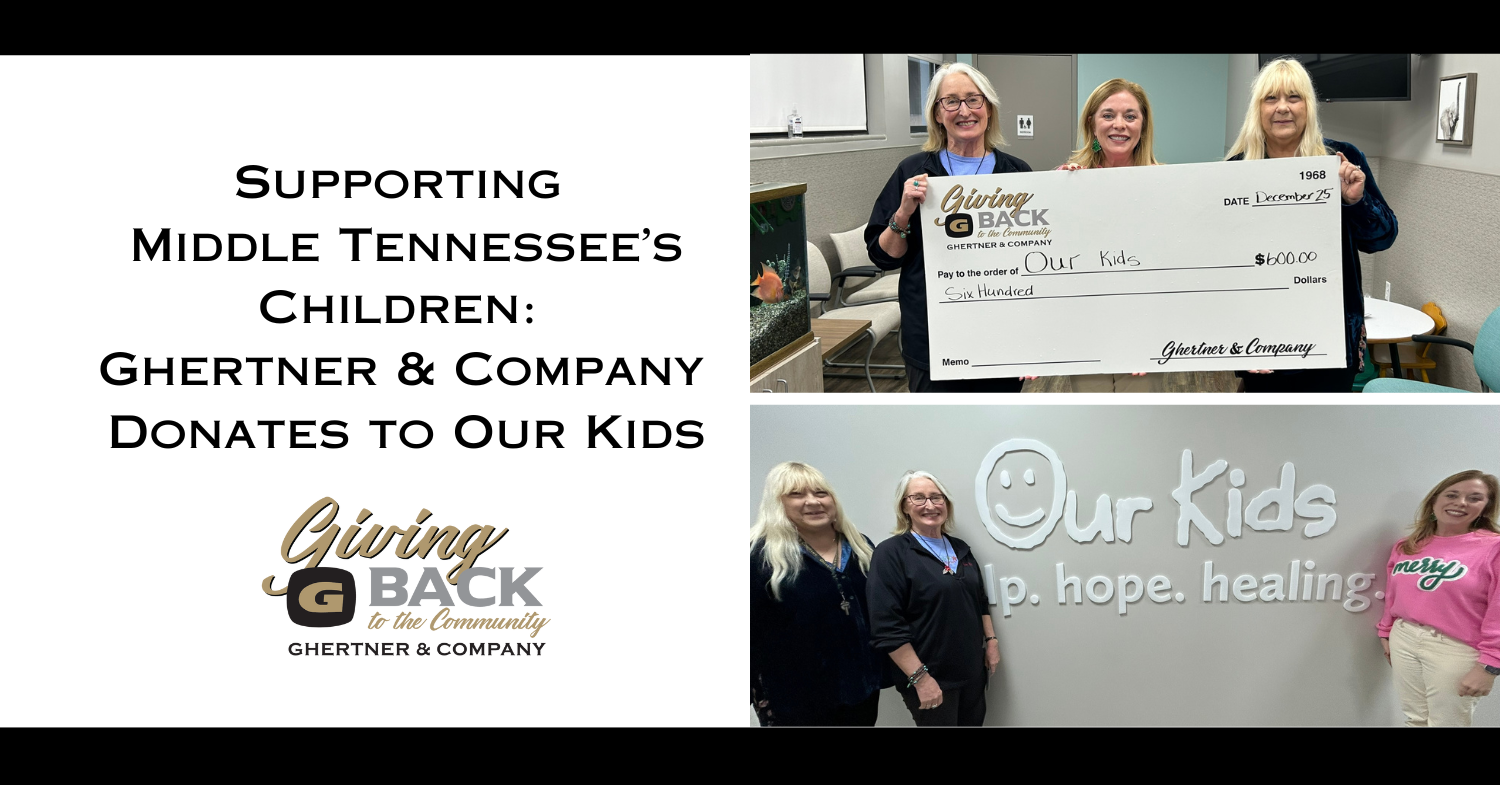

As part of its Giving Back to the Community Initiative, Ghertner & Company donated $600 to Our Kids. For over 19 years, Ghertner & Company has supported this local Middle Tennessee nonprofit that provides free medical evaluations and crisis counseling to children across the region. In 2025, Our Kids renovated its space, providing new, welcoming meeting and exam rooms for clients. In 35+ years of work, Our Kids has evaluated more than 31,000 children. To learn more and support Our Kids, visit www.ourkidscenter.com.

A Homeowner's Guide To Community Association Finances

At the end of each year, community association Boards of Directors work to create a budget for the upcoming year, including setting the community association fees that each homeowner is required to pay. While paying dues isn’t the most appealing aspect of living in a community association, the financial support of all homeowners is crucial to the community’s success. To help you better understand community association finances, we’re answering some commonly asked questions.

What financial accounts does my community association have?

Every association has at least two accounts, an operating account and a reserve account. The operating account is similar to your personal checking account, with funds used to cover day-to-day expenses for your community. The reserve account is similar to your personal savings account, with funds used to cover large capital projects or other HOA expenses. Healthy reserve accounts play a crucial role in helping communities avoid special assessments and addressing long-term needs. For condos and townhomes, it is recommended that a minimum of 10% (or more if needed) of your income be allocated to reserves.

What expenses do my community association fees cover?

This varies among communities, but can include insurance, administrative fees, legal fees, landscaping, utilities, or common area maintenance, as applicable.

How does the board determine the annual budget and the price of community association fees?

Your board uses financial reports from the current year and previous years, along with updated pricing for the coming year’s contracts for various services, and the board’s financial goals for the community to set your fee. Whether your community association fee stays the same or increases for a given year is driven by your community’s individual circumstances. Inflation increases in maintenance costs and general overhead, capital improvements, and the overall economic environment all affect your community’s fees.

How do reserve studies aid the board in making financial decisions for the community?

Reserve studies assess the condition and longevity of a community’s common elements—ranging from a pool or clubhouse to the shared buildings/roofs of a condominium or townhome. It provides a financial plan for the community, considering the anticipated replacement costs of various items and the timing of their replacement. Reserve studies help your board fulfill its fiduciary duty to the community and make informed financial decisions for both short-term and long-term needs.

Why does my community association need insurance, and how does it impact community association finances?

Community association insurance ensures that the structures, services, and amenities you rely on (and your community association fees pay for) remain protected, no matter what happens. Due to rising labor and material costs, as well as an increase in natural disasters across the U.S., insurance rates are increasing. If your community files a claim, rates may be higher, resulting in higher HOA fees

Understanding what your community association fees support is the first step toward appreciating their value. Your board is committed to using these funds responsibly for the success of your community. Your financial participation is an investment in your shared community.

*Please note that each community association’s fees are different. Please review your community’s financials and budget by logging in to portal.ghertner.com.

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

Ghertner & Company Gives Back to Community Through Food Drive

Ghertner & Company is proud to support our community when needs arise. Our team recently collected food and hygiene supplies for The Branch of Nashville. This local food pantry serves families and individuals across southeast Nashville, donating 1.3 million pounds of food annually. Several boxes of items were donated to the organization that will help families in need. Thank you to our associates who donated!

To learn more about The Branch, please visit https://www.thebranchofnashville.org/.

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

CAI TN LAC Members Advocate for Community Associations on Capitol Hill

Legislation at all levels of government has a direct impact on community associations. The Community Associations Institute (CAI) actively educates legislators on these vital self-governing entities through its state and national Legislative Action Committees (LACs).

Members of the CAI Tennessee LAC recently joined over 200 other LAC members in Washington, D.C., for the 2025 CAI Congressional Advocacy Summit.

These community association industry leaders held impactful meetings with 82 representatives and 64 senators. Their mission was to discuss critical policy issues affecting the community association industry, including the professionals who work within it and the residents who call these communities home.

Jaye Kloss, Ghertner & Company’s Director of Social Media and Marketing, has chaired the CAI TN LAC for four years. Kloss and committee members, HOA attorney Scott Weiss, and former Ghertner & Company community board member Linda Southergill. met with staff for Tennessee Congressman Scott Desjarlais and Senators Bill Hagerty and Marsha Blackburn to discuss issues impacting community associations across the state.

For more on CAI’s national policy priorities and the issues championed at the summit, visit https://bit.ly/caipolicypriorities.

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

The Power of Partnership: Annual Trade Show Empowers Board Members

One of the many benefits of working with a community association management company is access to a wide range of association vendors. Ghertner & Company prides itself on providing board members with opportunities to meet new vendors, and our trade show every fall is their most significant chance to do so.

We had a record 43 vendors in a variety of specialties at our 12th annual trade show, who shared their services with over 100 board members and associates. We also held three workshop sessions for board members to enhance their association knowledge, enabling them to lead their communities better. Workshop topics included the account delinquency process, home repairs for water damage, and the importance of HOA insurance.

Thank you to all those who participated, including our vendor sponsors and workshop speakers, for making this day beneficial for our board members.

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

Golf Classic Brings Board Members, Vendors Together for Day on the Course

The heart of every community association is its Board of Directors. These volunteer leaders work hard to lead and make decisions in the best interests of their community. Ghertner & Company loves to celebrate board members’ efforts and recently did so during our second annual golf classic.

Over 100 board members joined us for a free day of golf at Old Hickory Country Club. The day included competitive longest drive and closest-to-the-pin contests, along with prizes for the top three teams.

Beyond the fairways, board members used this time to connect with trusted industry partners at sponsored holes, discussing critical community solutions and networking for the year to come. Additionally, our 19th Hole Party invited non-golfing board members to the event, providing them an opportunity to mingle with one another.

Thank you to all the board members, associates, and vendor sponsors who made this day a success!

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

Ghertner & Company Supports Nashville Parks Foundation

Giving back to the communities we serve is an important value of Ghertner & Company. Each quarter, we identify a local non-profit to which we will donate $500.

This quarter, we are partnering with the Nashville Parks Foundation in its mission to promote wellness, create community, and increase prosperity in Nashville. Our donation will support programming and improvements to the 189 parks, 27 community centers, and other amenities throughout Metro Nashville.

For more information about the Nashville Parks Foundation and to see how you can offer support, visit https://www.nashvilleparksfoundation.org

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

Strong Vendor Partnerships: The Backbone of Community Association Success

By Dr. Angela Stone, CMCA, AMS | Director of Education & Development

In community associations, vendors may often work behind the scenes, but their impact is front and center. From landscaping and roofing to general maintenance and repairs, vendors influence everything from curb appeal to safety and long-term asset preservation. For boards, ensuring the right vendors are in place isn’t just helpful, it’s essential.

At Ghertner & Company, vendor management is one of the most critical services provided to the communities we manage. Our role goes far beyond simply recommending a contractor. We bridge the gap between vendors and associations, helping to identify, evaluate, and monitor qualified professionals who can meet the specific needs of a property while also protecting the association from unnecessary risk.

Most of the vendors we work with come to us as referrals from our team of experienced managers, which gives us access to a broad, proven network of professionals. But regardless of how a vendor is introduced, every one of them must complete a standardized vendor packet and provide proof of general liability and workers' compensation insurance before performing any work. This process is in place for one clear reason: to ensure the association is protected from liability.

It’s not uncommon for a board to have “a guy” they trust for a certain job, but if that person lacks proper insurance coverage, even a simple repair could expose the association to litigation. We’ve seen how easily good intentions can create bad outcomes when proper vetting is skipped. Our job is to prevent that.

In addition to initial onboarding, we monitor vendor compliance over time, verifying insurance coverage annually and tracking performance to ensure work is completed at the standard our clients expect. If a vendor fails to meet expectations or puts an association at risk, we do not continue the relationship.

The vendor relationships that matter most are the ones built on professionalism, reliability, and trust. These relationships help build strong relationships between Ghertner & Company and the associations we serve. Strong vendor partnerships often take years to develop, but they pay off in long-term consistency, responsive service, and fewer headaches for everyone involved.

Our team maintains a dynamic list of vendors across key service categories. These vendors have earned their reputations - not by favoritism, but by consistently delivering high-quality results. Still, we’re flexible. If a board has a preferred vendor they’d like to work with, we ensure the necessary protections and documentation are in place before work begins.

Ultimately, vendor relationships are not just about contracts; they’re about collaboration. Communities thrive when boards, managers, and vendors are aligned and working together.

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

Harpeth Trace Estates HOA Recognized as Tree Sanctuary

Ghertner & Company proudly congratulates Harpeth Trace Estates HOA for its certification as a tree sanctuary by the Tennessee Urban Forestry Council in December 2024.

Harpeth Trace, a unique community outside Nashville near Percy Warner Park, boasts over 100 trees in its common areas. To achieve the sanctuary certification, the community identified 23 unique tree species, all native to Tennessee.

The Nashville Tree Foundation and homeowner Vicki Turner in Sugartree, which is also managed by Ghertner & Company, helped the community identify trees and supported Harpeth Trace throughout the certification process. Sugartree HOA is a Tennessee Urban Forestry Council-certified level four arboretum, which you can learn more about here.

Harpeth Trace board and landscape committee member Dillon Blankenship and homeowner Jennifer Kimball contributed to the project.

Blankenship noted the community’s excitement regarding the tree sanctuary.

“The certification acknowledges our neighborhood’s exceptional natural space and commitment to using best management practices when maintaining its trees, “ Blankenship shared.

To learn more about Ghertner & Company’s Sustainability Initiative and community sustainability projects, click here:

Connect with Ghertner & Company on social media.

Giving Back to the Next Generation: Ghertner & Company Partners with Benton Hall

Ghertner & Company is proud to support Benton Hall Academy, a private school in Nashville for students with specialized learning needs.

As part of its Giving Back to the Community initiative, Ghertner & Company recently donated $500. One of our Ghertner & Company associates has a child who attends Benton Hall and has benefited from the school’s support.

Benton Hall serves students in grades 4-12 and had 55 students in the last school year.

Founded in 1977, Benton Hall was established to offer a curriculum designed to challenge each student to his or her highest intellectual and creative abilities.

Ghertner & Company believes in supporting organizations that make a profound difference in our community. To learn more about Benton Hall Academy or donate, visit www.bentonhallacademy.org.

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

The Power of Connection: Essential Communication Tips For Your HOA

Effective and clear communication is at the heart of every successful community association. Keeping homeowners updated about upcoming events, important updates, and the financial status of their community association creates transparency around board decisions. It shows homeowners the board is committed to their community’s needs.

Emails: This channel is a great way to communicate with your homeowners for quick, timely updates. Emails can be used in various ways, from sharing upcoming events to communicating trash service changes or sending reminders about community rules. Ensure that homeowner emails are up to date and that any emails that bounce back are promptly addressed.

Newsletters: Community newsletters offer a valuable opportunity for positive communication. They highlight community events and accomplishments and communicate important news to homeowners. Newsletters are lighter than other types of communication, allowing for a break from more serious communications needed throughout the year. As a bonus, give the newsletter a fun name to create community spirit!

Social Media: Social media pages or groups shouldn’t be considered an official form of community association communication. Instead, these groups should be utilized as additional contact points for community news. Event page features on social media can help boards promote community events and track attendance. Boards should set clear standards about what is allowed, who monitors the group, and how people can join. If participating in social media, boards should consider adding cyber insurance to their policy for protection against potential risks.

Meetings: Whether a board or an annual meeting, meetings are a powerful communication tool for your community. Ensure meeting minutes are prepared promptly after meetings and are available for homeowners to view. Even if individual members disagree, the board should always project a united presence when homeowners are present. Homeowners need to see the board working collaboratively for the good of the community, rather than engaging in internal arguments.

To learn how Ghertner & Company can help you effectively communicate with your homeowners, including leveraging our exclusive owner’s portal, request a management proposal today at https://ghertner.com/request-for-proposal.

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

Ghertner & Company Volunteers with Habitat for Humanity ReStore

Ghertner & Company proudly supports Habitat for Humanity of Greater Nashville and its commitment to building strong communities across Middle Tennessee.

A pivotal element of Habitat for Humanity's operational model is the ReStore. Powered by donations, this retail space offers a diverse range of home goods at accessible prices. It serves as a valuable resource for residents seeking materials for renovation projects or unique furnishings.

ReStore is unique in that 88 cents from every dollar of profit earned goes directly back into Habitat for Humanity to help support land purchases and development of Habitat communities.

One of Ghertner & Company’s teams recently volunteered at ReStore for an afternoon of team building and giving back. They sorted, organized, and priced donations in the warehouse.

“This was such a rewarding experience, and we were all glad we participated!” said Dr. Angela Stone, CMCA, AMS, Director of Education and Development at Ghertner & Company.

To learn more about Habitat for Humanity and ReStore, and how you or your community can volunteer, visit www.habitatnashville.org.

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

Revitalized Clubhouse Enhances Wynbrooke Community

Community associations offer homeowners a variety of amenities, including clubhouses. Clubhouses are great for community events, and some communities allow homeowners to rent them for private events.

Wynbrooke HOA in Hendersonville, TN, recently completed renovations for its clubhouse, which started last fall. Fresh paint, a new kitchen backsplash, new doors, furnishings, ceiling fans, and light fixtures brightened up this space, making it warm and inviting for homeowners.

These improvements make the clubhouse more enjoyable and contribute to the overall appeal and value of homes within Wynbrooke.

A homeowner volunteered to take on the project and coordinated the work, picked all furnishings/accessories, and worked with the board on the budget.

Way to go to the Wynbrooke community for working together to improve your space!

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

Gallatin HOA Celebrates 8th Annual Easter Egg Hunt

Spring and summer bring warmer weather to our community associations, and we love to see communities get outside and take advantage of it!

Carellton HOA in Gallatin, TN, recently celebrated Easter with an Easter egg hunt and golf cart parade featuring the Easter Bunny.

Around 100 children participated in the eighth annual event, with a whopping 1,695 eggs to hunt, including several special prize golden eggs for grabs.

Ready to get involved with social events in your community association? Contact your Community Association Manager at portal.ghertner.com for more information.

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

Building Hope Together: Ghertner & Company Gives Back to Habitat for Humanity

Ghertner & Company is committed to forming strong communities across Middle Tennessee and partnering with organizations that want to do the same, like Habitat for Humanity of Greater Nashville. Habitat brings people together to build homes, communities, and hope throughout the region.

Recently, Ghertner & Company donated $500 to Habitat for Humanity to support its mission. We are proud to manage Village by the Creek, a local Habitat HOA. For every dollar Habitat for Humanity receives, 88 cents goes directly to its efforts to support the local community.

A vital part of Habitat for Humanity’s funding comes from ReStore, its donation-driven retail stores.

“It would be really hard to do the work we do without ReStore,” Jeff Bennett, Senior Marketing Manager for Habitat of Greater Nashville, shared.

With locations in Nashville, Dickson, and Lebanon, homeowners in Ghertner & Company-managed community associations can support ReStore and Habitat for Humanity in several ways:

Shop: Find unique home goods and appliances at discounted prices at your local ReStore.

Volunteer: Give back to the community at a ReStore or a Habitat building site.

Donate: Contribute new or gently used items like appliances, furniture, and lighting. Habitat can bring a truck to collect donations on community-wide clean-up days.

Deconstruct: Before starting your next home project, donate your building materials to ReStore. Habitat will do the demo for free!

For more ways your community association can support Habitat for Humanity, please visit habitatnashville.org.

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

Strong Partnerships, Strong Communities: Highlights from VENDORPALOOZA 2025

Successful community associations are built on strong partnerships. Ghertner & Company values working with vendors who understand the unique needs of community associations and deliver excellent service.

As part of our commitment to these crucial partnerships, we hosted our 2nd annual VENDORPALOOZA. Our spring vendor trade show introduced our Community Association Managers to new vendors interested in expanding their business relationships with Ghertner & Company.

This year’s event featured 47 vendors across various specialties, including landscape architecture, pressure washing, community security, fire protection, and more. It was an excellent opportunity for our managers to engage one-on-one with these professionals and explore how their services could help meet the evolving needs of our communities.

It was a fun-filled day for our associates and vendors with food trucks, games, and prize giveaways!

Events like VENDORPALOOZA reflect our mission: to deliver community association management excellence by building strong, collaborative relationships with our clients and vendor partners.

Thank you to all the vendors and associates who participated in VENDORPALOOZA 2025! We are already looking forward to next year.

Connect with Ghertner & Company on social media.

Elevate Your Community's Potential with Ghertner & Company's Expertly Trained Managers

When you partner with Ghertner & Company, you're working with a company that understands the full scope of community association management and the importance of investing in our team. Our comprehensive training program ensures every manager is equipped with the skills, knowledge, and confidence to serve your community with excellence!

Onboarding: From day one, managers are introduced to the Ghertner & Company approach to all facets of community association management. New managers also get hands-on experience by partnering with senior managers in the field, visiting properties, and attending Board meetings.

Industry Certifications: Ghertner & Company encourages managers to pursue the Certified Manager of Community Association (CMCA) designation. This national certification demonstrates a manager's competency to lead and manage a community association and guide boards through challenging situations.

Strong Board Relationships: As managers progress in their careers, so do their communities' challenges. Managers are trained to ensure compliance, budget management, protect property values, and streamline operations, directly supporting your Board's strategic goals and decision-making.

Discover the difference that a well-trained Community Association Manager will make for your community by requesting a proposal today.

Connect with Ghertner & Company on social media.

Understanding Your Community Association's Insurance Coverage

Unlike most community association management companies, Ghertner & Company takes extra steps to ensure your community has the right insurance coverage. Protecting your community’s finances and assets is essential, and just as homeowners insurance protects individual properties, community association insurance protects your community.

Various scenarios, from fallen trees on common property to injuries at the pool or damage to entrance monuments, highlight the importance of having the right insurance. Community association insurance ensures that the structures, services, and amenities you rely on remain protected, no matter what happens.

Key Types of Community Association Insurance

Property & Liability Insurance

Also known as a package policy, this is one of the most critical types of insurance for community associations. It covers common areas (e.g., fences, monuments, and amenities) in case of damage or loss and building reconstruction in condominium or townhome communities.

Directors & Officers (D&O) Insurance

This policy protects the Board of Directors from personal liability related to decisions made on behalf of the association.

Workers’ Compensation Insurance

Ghertner & Company requires all vendors working with your community to carry adequate workers’ compensation insurance. However, your association should also have coverage if a vendor’s subcontractor lacks insurance or experiences a lapse.

Umbrella Policy

An umbrella policy provides extra liability coverage beyond standard policies. If your community has a pool or other high-risk amenities, Ghertner & Company strongly recommends this additional layer of protection.

Cyber Insurance

With the increasing risk of cyber threats, cyber insurance protects against financial loss due to malware or hacking. This is especially crucial for associations that pay vendors via ACH transfers.

Understanding Insurance Costs

Your association dues cover the cost of your community association’s insurance. Due to rising labor and material costs and increased natural disasters across the U.S., insurance rates in Tennessee are increasing by 25-50%. If your community files a claim, fees could be even higher.

How Ghertner & Company Ensures Proper Coverage

To prevent coverage lapses, Ghertner & Company has an in-house insurance auditor who:

Reviews policies annually to ensure proper coverage limits.

Works with Community Association Managers to secure adequate insurance.

Verifies that all properties and amenities are covered, particularly in developing communities.

Need More Information?

Insurance is essential to maintaining a strong and financially secure community. To review your community’s policies, contact your Community Association Manager at email@ghertner.com or log into your owner’s portal at portal.ghertner.com to view insurance certificates.

Please note: This article is for informational purposes only and should not be considered legal or insurance advice.

Click below to log in to your HOA owner portal, view community information and governing documents, or submit a request.

Connect with Ghertner & Company on social media.

Dr. Angela Stone, CMCA, AMS: Championing Education and Development at Ghertner & Company

At Ghertner & Company, the emphasis on education and professional development is a cornerstone of its approach to community association management. A driving force behind this commitment is Dr. Angela Stone, CMCA, AMS, who leads onboarding, training, and ongoing development for associates while managing a team of Community Association Managers, Community Associates, and Administrative Assistants.

A New Career Path

Stone began her journey in community association management in 2016, seeking a career change from her role as an adjunct instructor for the Dept. of Chemistry at Tennessee State University. Deborah Wallace, Director of Administration at Ghertner & Company, introduced her to an open manager position, and Stone saw an opportunity that aligned with her passion for education and collaboration.

“I loved the idea of community associations because they bring people together with a shared goal,” Stone explained. “It’s rewarding to be part of the process that helps them achieve those goals.”

Recognizing her teaching background, Wallace was confident she would excel not only as a community association manager but also as a team leader.

“Angela’s passion for education has allowed her to take her role to a new level, benefiting both her team and the company as a whole,” Wallace said.

Bridging Education and Management

In 2019, Stone was promoted to Director of Education and Development, the same year that she began her doctoral studies in Education at Tennessee State University. She earned an Ed.D. in May 2024, with an emphasis on Curriculum and Instruction. Her studies enabled her to design effective, customized training programs tailored to adult learners’ diverse needs.

“Understanding different types of curriculum allows me to customize training for each individual while maintaining a standardized path,” Stone shared. This personalized approach ensures that each associate is equipped with the tools to succeed.

Innovative Training Initiatives

One of Dr. Stone’s standout contributions is the creation of the “Law and Order: HOA” training program. Drawing inspiration from the popular TV franchise, the program features panel discussions with local HOA attorneys, offering practical insights into legal challenges faced by community association managers.

“As I advanced in my role, I noticed recurring legal questions from team members,” Stone said. “I wanted to create a more fun, efficient way to address these concerns.”

Chanel Mumford, a Community Association Manager, praised the program for its practical benefits.

“The training deepened my understanding of HOA laws and regulations,” Mumford said. “It’s helped me handle legal challenges more effectively while minimizing risks for the associations I manage.”

Empowering Associates and Clients

Dr. Stone’s leadership in education and development ensures that Ghertner & Company associates are prepared to provide exceptional community management services. Her focus on professional growth reflects the company’s dedication to supporting its team.

“One of my greatest achievements is fostering education and development for our associates,” Stone said. “By supporting their growth, we’re able to deliver the highest quality service to our clients.”

Through her innovative programs and commitment to lifelong learning, Dr. Angela Stone continues to shape the future of community association management at Ghertner & Company.

To log in to your HOA owner portal to view community information and governing documents or to submit a request, click below.

Connect with Ghertner & Company on social media

2024 Manager of the Year Awarded to Theresa Savich

Theresa Savich, a Community Association Manager with Ghertner & Company, has been honored as the CAI Tennessee 2024 Manager of the Year. This prestigious award recognizes a manager who exemplifies exceptional dedication to advancing the community association industry.

Savich began her career with Ghertner & Company in 2010 as an administrative assistant and transitioned into a management role just two and a half years ago. Her journey reflects a remarkable commitment to professional growth and service.

“What I like most about being a manager is that I can do good and possibly help in all situations,” said Savich.

CAI TN Executive Director Faye Ellis praised Savich for her collaborative spirit, reliability, and unwavering dedication.

“If you give her an assignment, you can bet that it will be accomplished without supervision and with excellence,” said Ellis. She also highlighted Savich’s instrumental role in surpassing chapter fundraising goals for 2024.

Savich herself shared how meaningful her involvement with CAI TN has been.

“Being involved in CAI TN is very rewarding to me as a Community Association Manager,” she said. “It has shown me how to grow inside and out.”

Congratulations to Theresa Savich on this well-deserved recognition of her hard work, dedication, and contributions to community association excellence!